Calculate self employment tax deduction

This is calculated by taking your total net farm income or loss and net business income or loss and multiplying it by 9235. This formula works to determine employees allocations but your own contributions are more complicated.

How To Calculate Self Employment Tax Four Pillar Freedom

Get a personalized recommendation tailored to your state and industry.

. Ad Our clients typically receive refunds 7061 greater than the national average. Ad Time To Finish Up Your Taxes. Calculating your self-employment tax involves several steps.

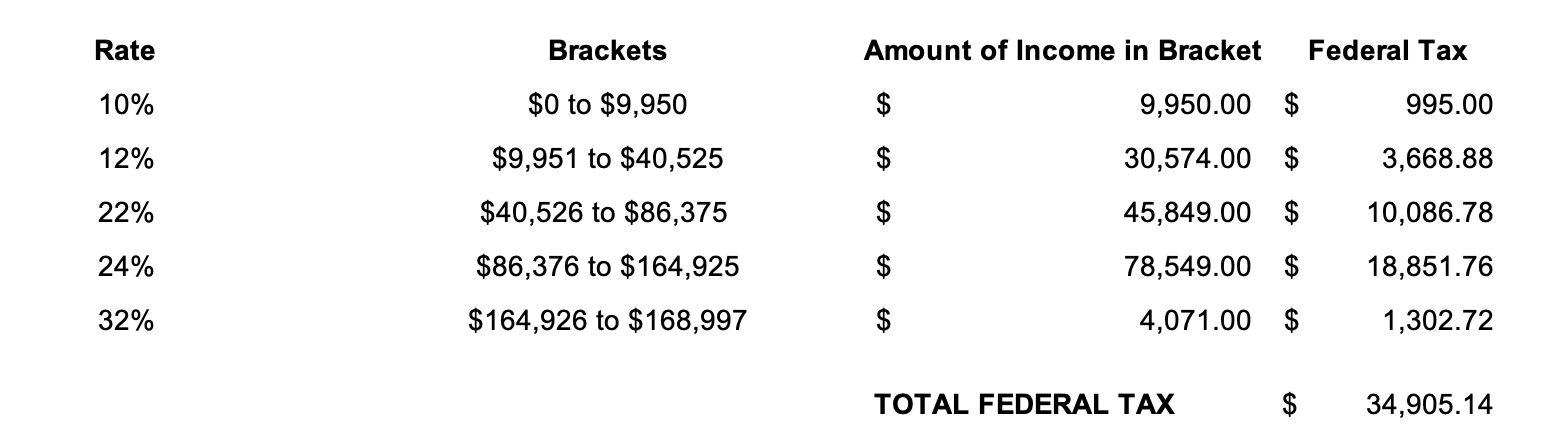

That rate is the sum of a 124 Social Security tax and a 29 Medicare tax on net. You cant simply multiply your net profit on Schedule C by. In this way the IRS differentiates the SE tax from the.

Discover The Answers You Need Here. How to Calculate Self-Employment Tax. Use this calculator to estimate your self-employment taxes.

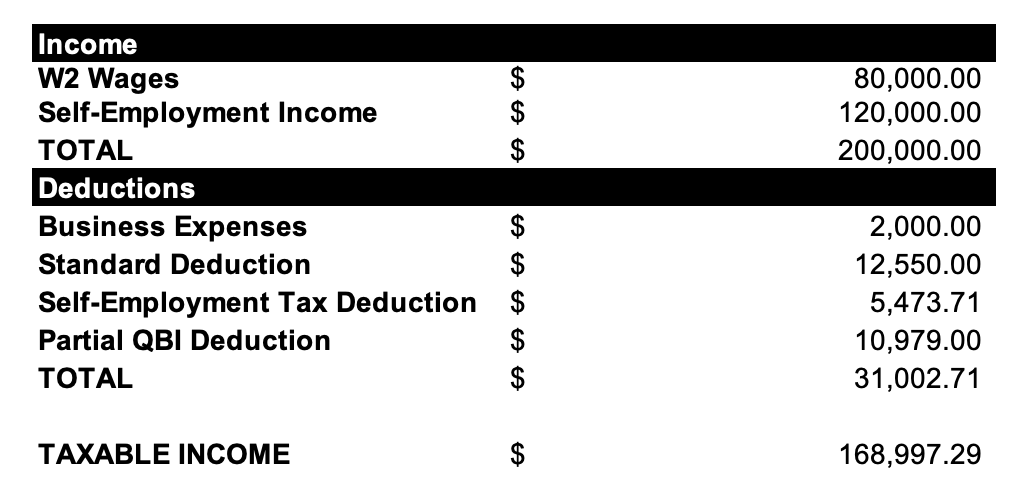

This is your total income subject to self-employment taxes. Add all net profit from your self-employment activities Multiply this amount by 09235 to account for the self. Ad Our clients typically receive refunds 7061 greater than the national average.

The self-employment tax rate for 2021-2022 As noted the self-employment tax rate is 153 of net earnings. Get a personalized recommendation tailored to your state and industry. According to NerdWallet the process of calculating self-employment tax begins with calculating your annual net earnings from self-employment.

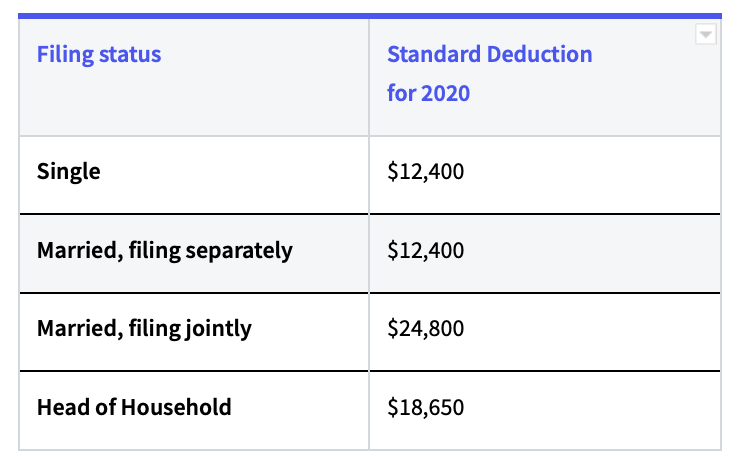

No Matter What Your Tax Situation Is TurboTax Has You Covered. Your self-employment tax total is calculated according to your net income including wages and tips. What is the self-employment tax deduction for 2020.

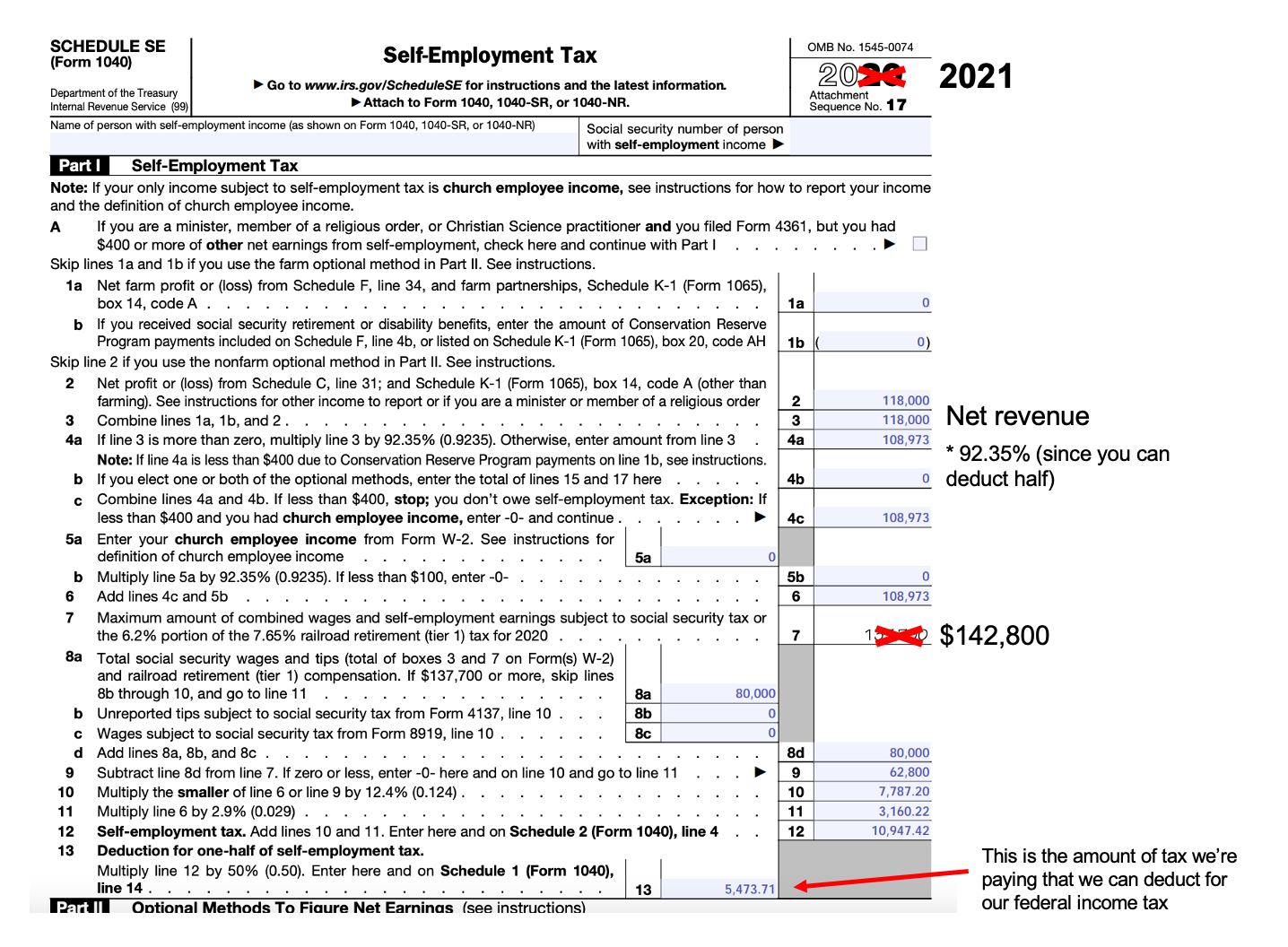

Import Your Tax Forms And File With Confidence. Next to calculate your self-employment tax look for Schedule SE SE stands for self-employment. For tax purposes gross income minus business expenses net earnings Typically 9235 of your net earnings from self-employment are subject to self-employment tax Once youve calculated.

Net earnings are usually your gross income. Do you have your calculator ready. Learn More From AARP.

Employers calculate Social Security and Medicare taxes of most wage earners. You calculate your self-employment tax on Schedule SE and report that amount in the Other Taxes section of Form 1040. Here Are Things to Keep In Mind Before Filing Your Taxes.

Normally these taxes are withheld by your employer. Once youve determined how much of your net earnings from self-employment are subject to tax apply the 153 tax rate. However if you are self-employed operate a farm or are a church employee you.

First multiply your net income by. This is your total income subject to self-employment taxesThis is calculated by taking your total net farm income or loss and net business income or loss and multiplying it by 9235. Ad Find Tips to Help You Figure Out Valuable Deductions and the Self-Employment Tax.

However you figure self-employment tax SE tax yourself using Schedule SE Form 1040 or 1040-SR.

Llc Tax Calculator Definitive Small Business Tax Estimator

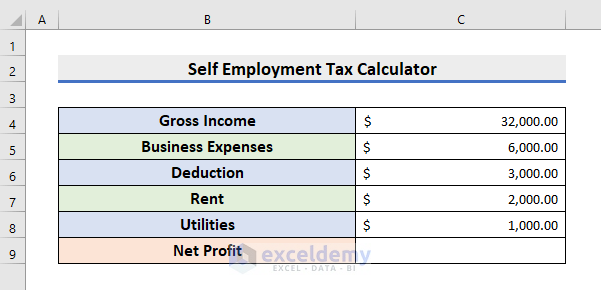

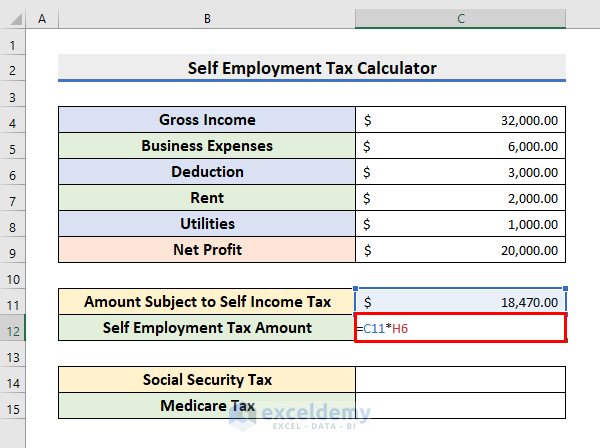

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

How To Calculate Self Employment Tax In The U S With Pictures

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Self Employed Health Insurance Deduction Healthinsurance Org

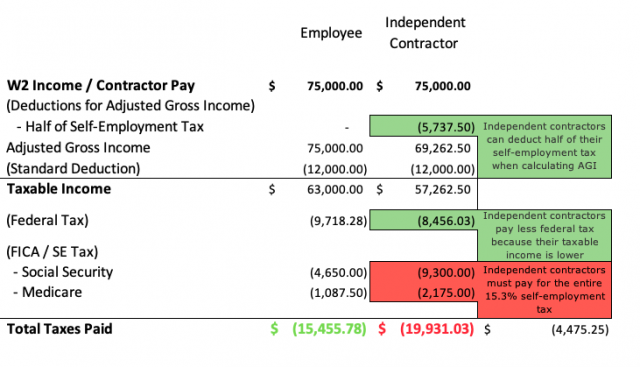

How Much In Taxes Do You Really Pay On 1099 Income Taxhub

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

A Guide To Taxes For The Self Employed And Independent Contractors

How To Calculate Self Employment Tax In The U S With Pictures

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Schedule C Income Mortgagemark Com

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

Self Employment Calculator Youtube

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

How Much Should I Save For 1099 Taxes Free Self Employment Calculator